Dec 1 2018

EndChain As The Solution For Logistic Problem

The development of globalization era bring out lots of changes in human living aspects. The globalization has been created the modern technology and discovered internet as the compliment in life. There are many advantages to internet usage. One of these advantages is the movement from the manual market into the digital market by using the digital purchase. As we know, the economy atmosphere in the world shows the improvement for one decade latest.

The digital transaction becomes the trend for people, because of more practice, effective and efficient. The digital transaction relies on the internet network in operation. The problem is coming when the seller can’t provide the trusted logistics and transportation. Then, the digital transaction present and able to change the cash currency into digital currency through the application by doing a top up for user wallet.

Besides that, the discovery of blockchain technology also can support global trading in the world. This condition makes some companies in this world innovate in creating the brand to facilitate and promote the digital world for the public.

The blockchain technology exists as the strongest case for the logistics and transportation matter. The blockchain technology can make the decentralized transparent transaction. The blockchain technology connects the product into a customer by logistics link — moreover, this technology work as revolution power for modern supply chains management. Based on World Economic Forum data, the global trade which is using the blockchain technology can improve up to $1trillion.

Then, the existing of blockchain itself makes several companies creating the solution for logistics and transportation problem. One of them is EndChain. EndChain is working in a logistic chain which focuses on transferring the good from the manufacturer into reseller and customer. EndChain as a problem solver for the logistics industry with utilizing the blockchain that easy to use for chain supply ecosystem.

The work of EndChain is coordinating the producers, the transportation or logistic service, reseller and another party to realize easier and transparent transaction. EndChain goals are to minimize the disruption of the logistics industry by open protocols, decentralized, and utilities. If we overview the digital market problem, two serious problems become the background, there are:

- Less of transparency

The logistics are tracking management using out of the date system which doing the goods input manually such as using the paperwork. The logistics service oblige to maintain the goods until receiving in customer’s hand. The tracking is lack of transparency while working. In many cases, the customer receives their order in broke condition, delay for a long time, and nothing detailed information about tracking history. Finally, the consumer feels uncomfortable and disappointed. If the logistics industry still holds the manual system and not being up to date with the newest technology, the logistics service will be left over time by time.

The logistics industry should improve their transparency to consumer and producer. They will be comfortable and trust to make a purchase. To fix these cases, several companies combine the logistics systems with the latest technology; there are blockchain, the credit letter, and the delivery receipt. This innovation is offering the benefits for companies to take a risk for luxury goods such as the art, diamonds, gold, handbags, etc. Then, EndChain exists to provide the solution with low shipping costs which can be appropriate for all goods.

- Less of responsibility

The responsibility of the logistics service is an important point that should become the priority. The package has a high possibility of broken, lost, delay, or stolen. The companies will face the loss of these incidents. Furthermore, the producer should pay the compensation to the consumer. To overcome the problem, the companies are move into blockchain technology which is adapted to the logistics industry. Through blockchain, the transaction between sellers with the logistic party is recorded permanently. It will be documented and more trusted in shipping — the document named smart contract.

The smart contract has the function to determine who the party that must be responsible if there is an accident like stole, delay, lost or broken off the goods while shipping process. Then, the less responsibility also can be seen from the logistic server that didn’t update the tracking information. Some consumers will give the negative review for the seller, they going frustrated because their order status is unclear. This is become the serious homework for logistic management if unwanted to the left over the producer and consumer.

The Introduction of EndChain Technology

Fast operation and communication are a need for the shipping process. The logistics industry should provide a comfortable, trusted, and on time service. The EndChain Company commit to building the logistics management that converting the paper document which is limited on liability into the compatible form for all industry. The data input or verification process of usual logistic can spend much time until the day, but by using the EndChain platform, the verification can be done in several minutes only with no human intervention. The EndChain technology is adaptable for all manufacturer and producer.

The base concept of EndChain is to reduce the logistic cost. As we know the logistic cost is very high in this decade. It will burden the businessman or producer. By using the blockchain technology, the cost will be reduced, and the burden of the producer will reduce too. The EndChain platform is completed with barcode and QR scan. These features have a different function that can’t be separated. The barcode and QR code is easy to use in all time and all places. The barcode and QR scan is the great combination which contains lots of conveniences and advantages for people. These advantages can be summarized for two major.

- Increasing the productivity of the logistic employee

The barcode and QR code usage is helpful for the workers. In general logistics management, the worker should arrange the package and verify them one by one. It will consume time too much. Besides that, the manual process not effective to do. For example, first the worker receive the package, they making a paper document for the package, they input the data manually. If in a one day 1000 packages should be verified, the process will not be effective and efficient. By using the EndChain which combining the blockchain technology, these risk can be decreased. Just doing one way to verify the package, scan the barcode. The employee will save time and more productive.

- Increasing the transparency of transaction

After the packages are scanned, the data will be updated automatically on the legacy and blockchain system. The EndChain program will detect the barcode as soon as possible. Then, the detailed information will appear and recorded directly. EndChain was designed with the method that compatible and easy to integrate with another system and store. Such as the B2B and B2C store. By using the EndChain, the transparent transaction will be created; the customer won’t be frustrated anymore. This is a very simple technology that contains significant advantages for people around the world.

If you’re interested to know more about EndChain, you can visit our sites on:

Ann Thread: https://bitcointalk.org/index.php?topic=5055264

Website: https://www.endchain.io/

White Paper: http://www.endchain.io/#language

The EndChain Features

The EndChain program is available with several features that allow the user to get the new experience in the digital market. For this time, the EndChain still seeking build the strong features to complete the program. The features of EndChain are:

- The privacy system

To secure the data of package, the privacy system should be working extra. The privacy feature of EndChain allows the companies to decide the data that can be entered into the program. The validated data will be encrypted by blockchain then it will build the safety system. Our program can be settled to receive QR barcode of certain or all products. The users can write the key permission as requirements to use the program. The history of order is opened for the customer only. So, the risk of data loss is impossible. By using the EndChain program, the human error factor will, and the privacy will be more protected.

- The direct communication

The direct communication is one of the EndChain features that allow the manufacturer as a sender giving the message to the logistics service — this feature able to monitor the location of the package and knowing the problem that may occur during the shipping process. Also, the report if the package is received. The direct communication is designed like the private message between two parties. They can communicate about the transportation process. This feature is so beneficial for both and able to improve the trust to the logistics service.

- The security for the goods

This feature has the function to minimize the theft incident that maybe occur to the package. EndChain completed with the theft detector and allowed the customer to get the information about that. The system will mark the potential person who steals the item. The theft can happen during the sending processor when transit. Then the buyer should enter the code number of the item; the system will search the location of the item. Finally, the consumer can report the theft into police. It’s different with a manual logistic system which can’t detect the theft if occur. This feature is really helpful for all parties.

- The smart contracts feature

This feature can give the manufacturer and transportation create their contract. The smart contract usually contains about the responsibility of both parties if something wrong. The mechanism of making a contract starts with two parties that put the coins. If the goods are received successfully, the coin will return into the most respect parties. If one party is breaking the contracts, they will get 0 coins. The smart contracts also able to save the logistics document in digital form. Then, the document can be used to supply the chain. The supply chain practice is more efficient.

- The big data feature

EndChain provides the large database that contains all interaction between manufacturer and transportation. The data also include the information about completed transportation. This feature aims to deliver the condition of items. Besides that, these data also become the evaluation for the logistics to identify the problem and planning the solution. This is one of the EndChain commitment to improving the planning and timing of logistic company itself. The big data are also working as a supporter of the coin price. The data will represent the price of a logistics company, include their service fee for a month. The user can choose the object that will be paid by the tokens.

The ICO Information of EndChain

The ICO of EndChain starts to sell at 1st on December 2018 until 15th on January 2019. When the token sale is running, the target of this sale should be reached. For the threshold is up to $4 million, and for the hard cap is $15 million. The seal will unstop until the maximum amount already done. EndChain can add the token stock if it’s possible and needed. The ICO details are consist of five rounds. Each round has the bonus and price differently. It’s created to accommodate the customer needs that adjusting with their budget. These rounds are:

1st round: $1.500.000 raising goal with price 0.160 USD

2nd round: $3.000.000 raising goal with price 0.178 USD

3rd round: $3.500.000 raising goal with price 0.200 USD

4th round: $3.500.000 raising goal with price 0.218 USD

5th round: 43.500.000 raising goal with price 0.240 USD

The EndChain users can choose the round that they want to buy. For each round contains the bonus up to 50%, 35%, 20%, 10%, and five giveaways. On each giveaway will take 40.000 tokens. The tokens stock for the first launched is up to 23.419.944 tokens for soft cap and 74.567.312 tokens for a hard cap. The EndChain project still needs the process of completing the program. That’s why we always open to the people to asking us the critic or suggestion through our social media on:

Facebook: https://www.facebook.com/EndChainIO/

Telegram: http://t.me/endchainIO

Jan 1 2019

Overcome The Logistics Problems With EndChain

The trading transaction via online having the consequences for all parties which involved in there. At least, there are three parties here, the seller/manufacturer/producer, logistics industry and consumer. Each party has the obligation and rights on this case. As we know, online trading allows the buyer and seller not meet in the market as trading as usual. Here, the seller needs the logistics help to send the goods to their consumer — the logistics industry work as the bridge between seller and buyer. The logistics have the responsibility to deliver the packages to the consumer. But, it’s not always run as well as we think, because it’s possible bad something occur while shipping process.

One of the most crucial problems of logistics industry is about transparency. Yes, the transparent transaction is the key for successful trading. The transparency while shipping process is an important part, such as the update information about the packages, include the location and condition itself. The secure and transparent transaction should be built if the logistics industry still wants to stand out in this era. The problems of logistics aren’t only lying on transparency, but also the technic procedure of shipping phase. Almost all logistics industry is doing their tasks with the manual method like using a paper to verify the package, filtering the package one by one, etc. These ways are out of date and consume lots of time.

What’s the solution to these problems? The answer is the logistics must be moving on to the modern ways through technology. In this digital era, the blockchain technology exists as the strongest problem solver for transportation and logistics problems. The blockchain is enabled to controlling and monitoring the transaction. The blockchain technology is coming with the power of revolutionizing for supply chain in modern ways. By implementing the blockchain technology in the logistics company, it can build the consumer and manufacturer trust in the logistics. The impact of blockchain usage can’t be understated anymore; the transportation management is able to hold their existence in the world market with 13% increasing of GDP global. It means the border communication and administration of $1 trillion trades are improved.

Some companies are implementing the blockchain solutions for their logistical problems, but it’s not a complete solution. Besides the blockchain is able to transfer the value and change the physical goods which transferred, but the RFID chips of blockchain are expensive. This fact such bad news for companies, because it means they should be spent more money or budget. It’s not a big matter if the company using EndChain. What’s EndChain? EndChain is one of the companies which develops the blockchain technology and focuses on the logistics chain issues. EndChain has the goals to be the blockchain solution for logistics industry itself and another party that involves in the transaction. EndChain provides new experiences for people with the new concept and system. Are you interesting to know more about EndChain program? Please follow our social media below. You will get the update information about EndChain.

Facebook: https://www.facebook.com/EndChainIO/

Twitter: https://twitter.com/EndChainIO

Telegram: http://t.me/endchainIO

Knowing The EndChain Design

The EndChain work involves several parties; there are a producer, shipper, seller, and consumer. For the first, EndChain will make the adaptation of the supply chain itself for each party, EndChain will record the goods that entered on the logistics. The record has the function to determine the high-risk goods. The record will give the data about.

It is important to know before the shipping process run. The brand, item, and originality of the product must be known. It’s done to avoid the counterfeits goods that will harmful for the consumer.

It tells us the party that controls the package. The owner of the product should be clear. Because it’s related with the responsibility if something bad happens, such as the delay tracking, stolen, or broken.

The product that will be sent should be known the quantity and quality. In one day, there are lots of package with different quantity. It’s important to mention the quality and quantity because it’s related to the risk during shipping.

This information will be stored on the QR code and barcode that available on EndChain. These data can’t be expired for a long time. So, it can be checking in real time. The barcode or QR code is provided by EndChain as the new concept for verification process on logistics. The manual checking while verifying the package isn’t recommended and not an effective way. EndChain create the barcode to make the conveniences for the worker. The worker just needs to scan the package for several seconds; the data will automatically be verified. This way will save time and also increasing worker productivity. To using the EndChain, the user have to understand the EndChain design itself.

The participant should register themselves on the EndChain form. Then, the participant will receive the identity that linked with the public key. For your information, the public key will connect the participant with the blockchain based. The participant can see another manufacturer, shipper, and seller. The data will be imported into the blockchain system. The users can interact with another user in one platform.

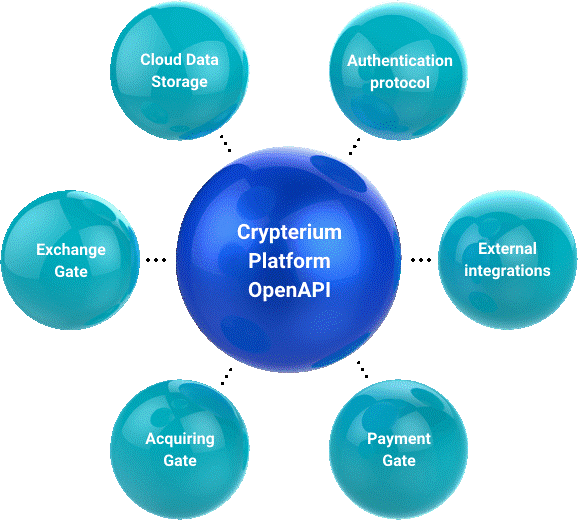

EndChain is placing the security system as a priority. The EndChain is work through the permission of blockchain, so the listed users who follow the manufacturing and logistic phase are able to join with the network. The detailed information will be accepted in a blockchain if there’s an authentication. The authentication is a way to protect the goods from counterfeit. The authentication form can be accessed on the cryptographic mechanism.

The EndChain doing the job consider by patent-pending barcode and QR code. This code integrates the physical goods with the digital information that entered the blockchain. The users are allowed to upload each item on the chain. The item will automatically have the unique id as identity. This design giving the conveniences for the user because the goods data is store safety.

We determine to build the concept using Ethereum network. Ethereum is a stable network and more compatible with blockchain technology. In the future, EndChain seeking to develop the program and innovate the new feature to realize the different, comfortable, and profitable for all people.

The current barcodes are provided for all items, but it’s not specific because the items with the same model have the same barcodes. In the future, EndChain will launch specific and integrate barcodes on each item. So, the logistics worker just scan one code and automatically the information will record at the same time. The data will be saved on a legacy system, so it can’t be expired for a long time.

EndChain still develops the progressive application and software that can be accessed for users. The software is building for a supply chain, and the website also designed for the customer. The improvement of features also should be run together with the improvement of the security system. EndChain will complete this improvement with the locked key to secure the data.

Overall, the design of EndChain program isn’t complete yet. EndChain always commits to innovate the new concept and system to reach the betterment experience for people around the world because the user satisfaction is our priority. For further information about EndChain, you can kindly visit our sites:

Ann Thread: https://bitcointalk.org/index.php?topic=5055264

Website: https://www.endchain.io/

White Paper: http://www.endchain.io/#language

The Token Distribution Sale

The ICO details for EndChain Company is starting from December 2018 until January 2019. The main aims of ICO are to make the EndChain become the largest and majority company which use in all companies to solve their logistics problems. The first token sale has the minimum target, $4 million for threshold and $15 million for a hard cap. The EndChain tokens distribution will be run via ICO. The EndChain tokens are consists of four categories; there are team, leadership, advisors and future development. The leadership and advisors tokens will be given to EndChain employees as an incentive for their dedication to the company. The tokens will be active for one year and locked in a smart contract. Then, the team tokens are created for the member of EndChain itself. The team tokens are consists of two form based on the position and the quality of working. The last one is future development tokens are created for the business interest, and the manufacturer. The percentages of these tokens are 55% for ICO, then 22% for future development tokens, 10% for team tokens, 5% for leadership tokens, 5% for advisors tokens and the last, 3% for bounty and referrals.

The Coin Distribution

The coin that entered by users will be used to improve the EndChain program and complete the features. The transparency of coin distribution is our way to giving the information for users; it’s beneficial to improve our confidence and our service. We are appreciated to all of you who trust us to handle these logistics cases. The coins that submitted on EndChain will be distributed into some interests in order to provide the comfort experience. It can be called the feedback for users. The distribution of EndChain coins are.

The marketing activities require the material to explain to the consumers how the EndChain work? The EndChain coins will be distributed for this activity. As we know, marketing is one of the company strategies to introduce their products to society. The marketing has the role of informing the manufacturer, logistics industry, etc. That there’s the solution to their problems.

To completing the marketing team, the administrative aspect also should be done well. If the marketing focuses on the spreading the EndChain products, the general and administrative aspect focuses on providing the material and manage the internal office of EndChain itself. This activity also needs the high cost.

The EndChain Company is also managing the legal permission. The consumer has the rights to receive the legal tokens and coin, so the legacy system should be built and covering all trading aspects. Besides that, the EndChain Company also obliged to comply with the legal rules of the state. Keeping the existence of EndChain is important.

The user data and blockchain information needs the extra security system. The EndChain coins also use to develop the security system. The EndChain seek to create a strong enough security system for the future. The EndChain coins that submitted are utilized for beneficial things and actions, especially for improvement.

The EndChain Roadmap

Since declare on November 2017, the EndChain has been ready with the roadmap and the targets for the next month and year. The roadmap is important to determine the policy direction — roadmap work as a reminder for the next step when the time to plan, to organize, to act, and to evaluate each agenda. You can see the roadmap of EndChain completely in our whitepaper that can access through http://www.endchain.io/#language. Here, the EndChain roadmap generally.

Actually, the development of EndChain concept has been started in March 2017. But, after facing some obstacles, finally, the EndChain teams doing the intense research and get the conclusion that the blockchain technology is able to help the problems of the supply chain. The EndChain always believe that this project is enough strategies to overcome the obstacle which may occur in the future. It’s just about how the EndChain able to hold the existence as the best solution.

By admin • Blockchain Technology 335 • Tags: ICO, information, long time, marketing, online, QR, security system, software, technology, transportation